David Lereah Watch Mentioned In Business Week

The David Lereah Watch was mentioned in Peter Coy's Hot Property column:

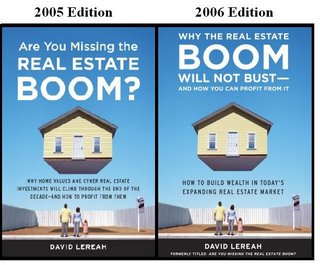

Every problem has to have a public face, and to many people, David Lereah is the public face of the housing slump. People say Lereah was too upbeat about house prices in the boom (he wrote a badly timed 2005 book called "Are You Missing the Real Estate Boom?" Now, they say, he has overreached to put a positive spin on the downside. There is an entire blog devoted to trashing the genial Lereah, who is chief economist of the National Association of RealtorsPeter Schiff's joke about David Lereah is phenomenal. LOL! :-)I'm not usually one for piling on, but I couldn't resist passing along this wisecrack about Lereah from Peter Schiff, the bearish president of brokerage firm Euro Pacific Capital, www.europac.net). It was emailed to me by his brother and publicist:

"If the National Association of Realtors chief economist David Lereah had covered the arrival of the Hindenburg in New Jersey in 1937 (instead of Herb "Oh the Humanity" Morrison) it too may have been described as a 'soft landing.'"